When I started writing this blog I asked myself what it should focus on. Should it be about branding – adapting the brand identity, developing the Chinese brand name (from the legal entity name to the much more complex consumer- facing naming architecture)? Should it be about product development strategy – adapting the product from the ground up to fit the market, and consumers’ lifestyle and aspirations, as well as reflect the competition? Or should it be about making marketing content fit the unique media landscape with specific local brand messaging and content strategy? And what about the more operational side, like establishing local partnerships, sales channels and even recruiting local talent?

The truth is, when you’re marketing a brand outside its home country, you face all sorts of challenges – and they’re all intertwined with each other. And nowhere is that more true than China.

In all my experience of adapting global brands for Chinese consumers, I can’t think of a single example where it wasn’t necessary to change positioning and marketing mix in a big way. I’ve transformed product positioning of consumer products like Kit Kat from a self-indulgent treat to a sharing sensation among friends. I’ve searched far and wide to find spokespeople for global brands like Lux and American Express who can truly resonate with a local audience and still stay in sync with the essence of those brands.

Of course, none of this precludes the eternal debate about how feasible or desirable it is to be globally consistent. Or the need to remember that ‘consistency’ doesn’t equal a one-size-fits-all literal interpretation of a tagline. How should HSBC speak in the same tone as the rest of the world as ‘The World’s Local Bank 环球金融 地方智慧’ (HSBC had changed its global brand platform to ‘World’s Leading International Bank’ since 2011) but express consumer benefits in a really direct way? How should a fast-moving fashion brand like H&M stand out by toning down its price point and promoting its trend credentials instead? How do British brands like Pret A Manger find their purpose and emotional attachments in the context of the local culture, so they do more than just sell food?

To make brands relevant and trigger loyalty that adds up to a sustainable price premium, global brands have to get in step with local cultural imperatives and operational realities. At the risk of over-simplifying or making sweeping generalisations, here are some thoughts about the differences they can expect to find in China.

Are you talking to me?

Language is perhaps the most tangible. One of the first tasks of the marketing plan is to develop the brand name (an equivalent of the global brand identity). That’s before you even start to develop and adapt the brand proposition, key messaging and overall content. To succeed, you need to understand both global intent and local context. If you blindly follow the conventional idea of consistency and ignore local nuances, you’ll almost certainly fail.

When it comes to Chinese names for global brands, going for the safe option of the phonetic equivalent will end up sounding like everyone else. But over-rationalizing could leave you with a name that reflects the marketing brief rather than sounding like something born natively for the local market. In 2017, Airbnb relaunched in China with a new Chinese brand name 爱彼迎(pronounced ài bi yíng) that means ‘welcoming each other with love’. But reaction has been mixed, with many already comparing the company’s strategy with other brands who have failed in China. According to AdAge, Airbnb spent a year deciding on the Chinese characters that made up the name, with brand consultancy Labbrand consumer testing over 1,000 possibilities. Yet the result has been widely criticized in the press and on social media.

Airbnb’s launch campaign in China

Names can be very subjective. So use clear criteria to help you choose. Once you’re down to a shortlist, research can be useful. Carefully testing names with your target audience will help you gauge appeal and weed out any unanticipated negative reactions. Research can’t tell you everything, and it shouldn’t be the only thing you use . Nor should it stop you taking calculated risks or simply trusting your instinct. But it does help guide decision-making and build consensus among your stakeholders.

It’s not just what you say, but how you say it

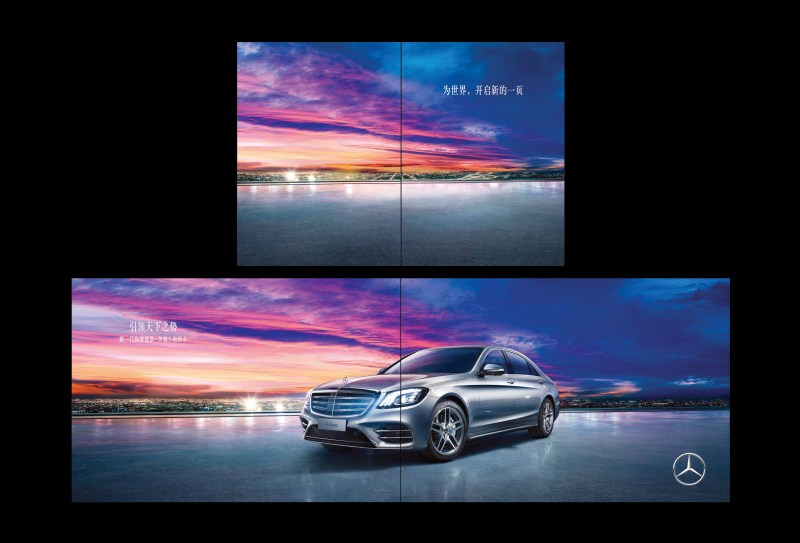

Another big difference for brands in China is how to talk about benefits. They need to be prominent, but brands also need to talk about what they mean for the greater good, not just the individual. , The western idea of reinforcing ‘what I want, and how I feel’ irrespective of societal consequences doesn’t work. So the brand communications of Holiday Inn Express, an InterContinental Hotels Group brand, emphasize ‘smart choice’ rather than just ‘efficiency’. Johnnie Walker’s ‘Keep Walking’ proposition that emphasizes endless striving for personal progression has to be ‘shared’ and ‘recognized’ among peers. Mercedes Benz, one of the best-selling brands in China, elegantly fused its global positioning with a Chinese declaration of ambition in a recent campaign, executed as a six-page gatefold ad with the headline ‘For the world, we open a new page’.

Mercedes Benz shows its presence in the Chinese market through heavy advertising spend, including this gatefold spread launched in January 2018.

It’s not just how you say it, but where

Comparisons between Western markets and China often focus on the difference in internet penetration and smartphone adoption. But the popularity of smartphones has increased dramatically in China. And digital platforms are evolving fast to become part of Chinese consumers’ daily lives.

China’s internet economy has now raced ahead of the West’s, making China a truly mobile-first market. Besides the sheer size that goes with a billion-plus population, it’s also ahead on features. Consumers in China can now use the internet, specifically WeChat 微信(Pronounced Weixin in Mandarin), to do an extraordinary number of things. Apart from messaging (the key feature when the brand launched in 2011), it’s evolved to include voice and video calls, integrated news and public service announcements, gifting, ride-hailing, food delivery, doctor/dentist bookings, and even visa applications. It integrates social media, search and e-commerce, all inside one walled garden. A recent official report estimates that, as of September 2017, an average 902 million users log in to WeChat daily, up 17% year-on-year, and send 38 billion messages.

WeChat’s reach is appealing for global brands. But it also makes it easier to do business in China by bypassing stringent licence requirements. On the other hand, its multi-disciplinary nature makes it incredibly challenging to create appropriate content fundamentally different to the fragmented content in the West.

As a start, an official presence on WeChat can help global brands control their marketing message in China, create personalised interactions with their audience and directly manage customer relationships through the app. All of that could have a huge impact on brand loyalty if they handle it with care. Chinese consumers can discover and find out about brands and their products, interact with trusted friends and buy items all through one platform. So content needs to fulfill long-term brand building objectives: bridging online and offline experiences, creating a distinctive tone of voice, acting as a customer service with social listening functions, and creating a seamless buying experience.

WeChat is extending its reach to a version for business communication called Enterprise WeChat. Among other things, it lets employees track their annual leave days and expenses, and clock in and out. To underline the scale of adoption, DiDi ChuXing, the latest brand success in China, has encouraged its 7,000 staff to communicate almost exclusively on Enterprise WeChat.

Don’t just spot differences, celebrate them

Chinese consumers are increasingly sensitive to how global brands behave in the market. Brands that celebrate local culture while skilfully infiltrating their global essence can win their hearts, especially if they bypass one-size-fits-all global consistency to craft a local tone of voice. Global brands need a ‘first follower’ in China to localize and lend authenticity to the brand. In 2017, Burberry chose China’s pop, movie and fashion sensation Kris Wu as their first local Key Opinion Leader (KOL). That opened up China’s millennial market, giving the brand social currency to let its message spread on the many social commerce platforms.

Another powerful tactic is to allow local interpretations of global ideas. In December 2017, Adidas re-imagined its ‘Original is never finished’ creative platform with a new set of creators from all over the world including Kendall Jenner, James Harden, 21 Savage, Young Thug, and Eason Chan. It proved that when you create freely, the outcome will always be original, globally.

The global edit:

The Hong Kong edit:

The Korean edit:

China is complicated. Economically, socially, culturally and demographically, not to mention politically – whichever way you look at China, it bears little resemblance to the West. And it keeps getting more and more complicated. So one blog will never cover all the golden rules on marketing there.

There’s no single route to success when launching your brand in China. But it’s safe to say you need a plan that works for your brand and product category, and your ambition in the market. There are also other issues, like product extension, local legislation, censorship, and product safety (especially for food brands). All these steps are essentials you’ll have to consider before developing any marketing strategy for China.

Note: I have contributed this blog to VengaGlobal and Gala. An edited version of it had appeared on my LinkedIn profile.

You must be logged in to post a comment.